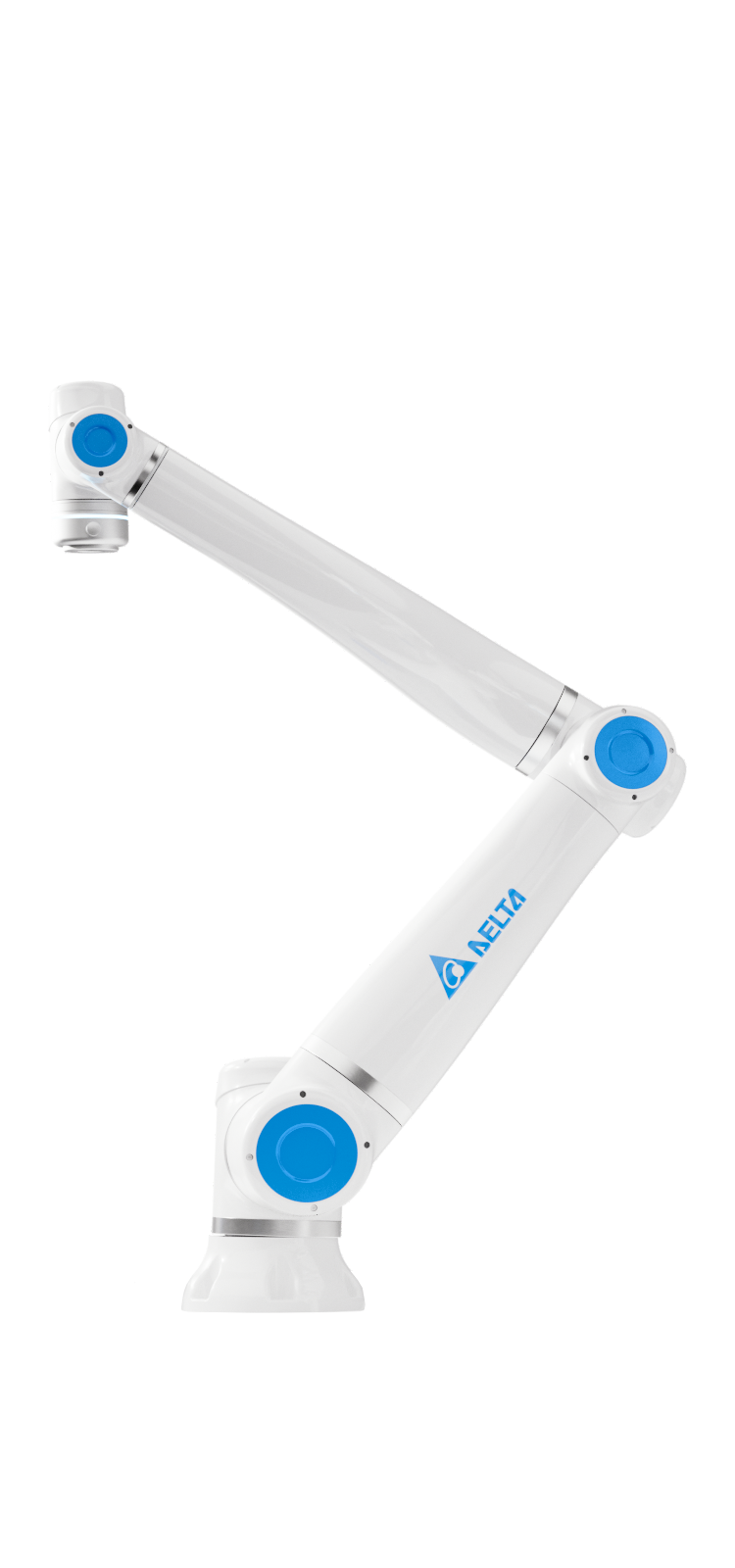

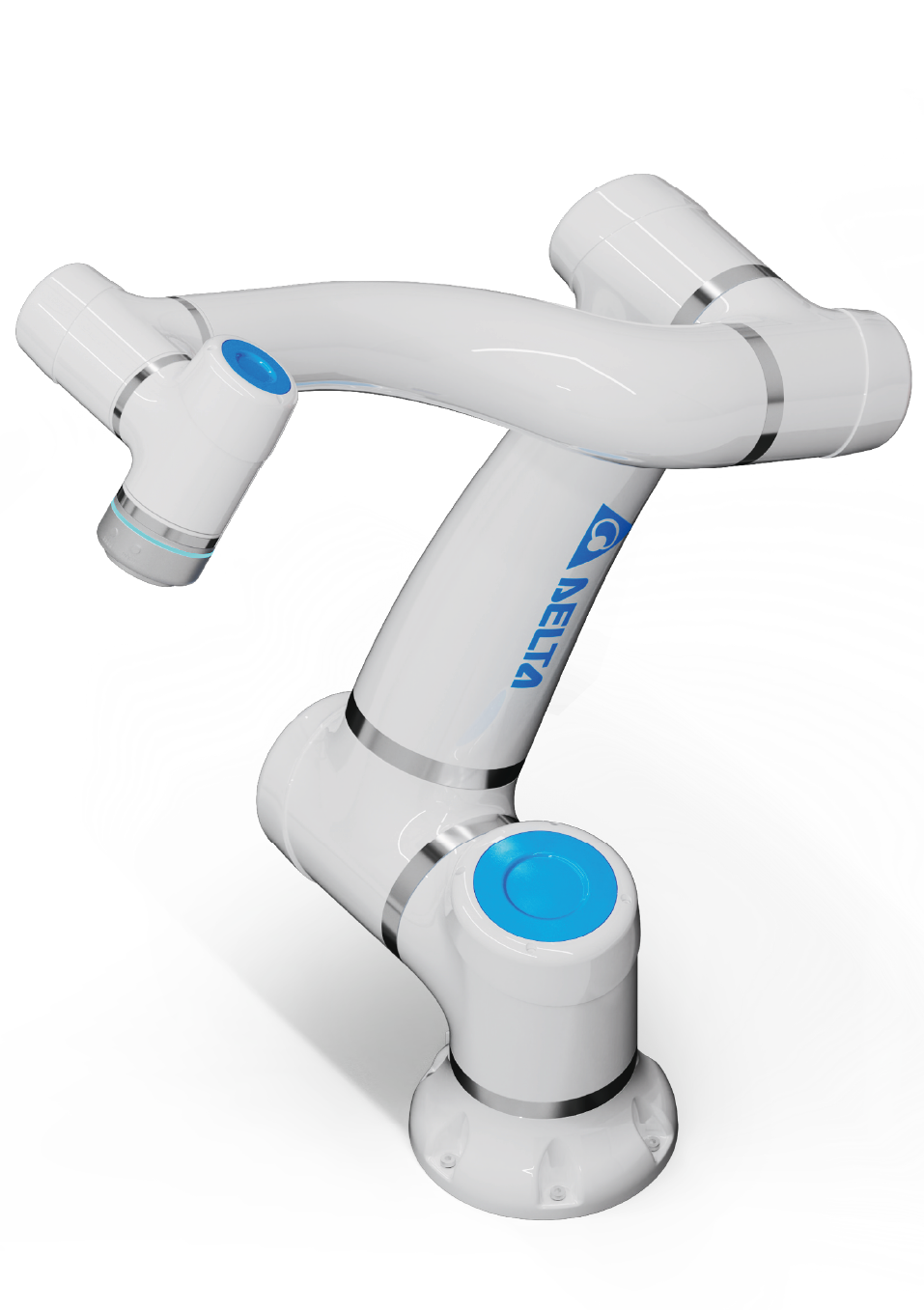

Your affordable and simple path to automation

Automation doesn't have to be complicated or expensive. With leasing, you can take the first step without the pressure of large upfront payments.

Together with our experienced partner, we guide you through every stage – from choosing the right solution to setting up a payment plan that works for you.

Our goal is simple: make automation accessible, transparent, and risk-free, so you can focus on improving your business while we take care of the rest.